Regardless if you are individually and have a negative credit rating, you will probably find that it is hard to get lending options. However, there are several financial institutions that include a number of capital options pertaining to do it yourself-employed people with bad credit.

More and more people give a standard bank which offers these plans would be to shop around. Assess prices, settlement vocabulary and requirements pertaining to self-utilized borrowers.

Lendmark Monetary Assistance

Lendmark Economic Assistance provides credit, loan consolidation and begin economic guidance. They provide unlocked and start attained loans at collection costs and commence vocabulary.

Additionally,they enter fiscal counseling and start allowance assistance. They help borrowers combine high-need fiscal into an individual reduced transaction.

The website doesn’meters type in significantly documents, and you wish to make contact with a cash loans online branch with regard to details. Her tiniest move forward circulation will be $5,000, that is fairly no as a private bank.

The organization were built with a inadequate scored inside Higher Commercial Relationship. There have been 167 complaints stored compared to it does earlier three years.

Thousands of stories associated with Lendmark Fiscal Assistance are generally unfavorable, and many of the focus on substantial-costs, hit a brick wall customer service and begin the necessary costs. Besides these complaints, they are doing posting give preference to credits, including programmed money.

Automated Fiscal Point out

If you were denied a vehicle advance because of bad credit or even you are a individually user, then Computerized Economic Express could be the all the way support along. The corporation associates you using a country wide link of dealers and start financial institutions the particular specialize in funds a person in a wide array associated with financial instances, for instance individuals who have experienced bankruptcy, repossession or separation.

It method is actually easily – it will take recently about three min’s or even significantly less to resolve a new first sort online. In which it turned out submitted, you will definately get a reply from fees by way of a standard bank in the firmrrrs companion relationship.

These plans are usually professional when you have low credit score or a good reputation for financial symptoms, thus costs can be previously mentioned you’d probably be able to in another country. Nevertheless, they may be the sole way for the borrowers.

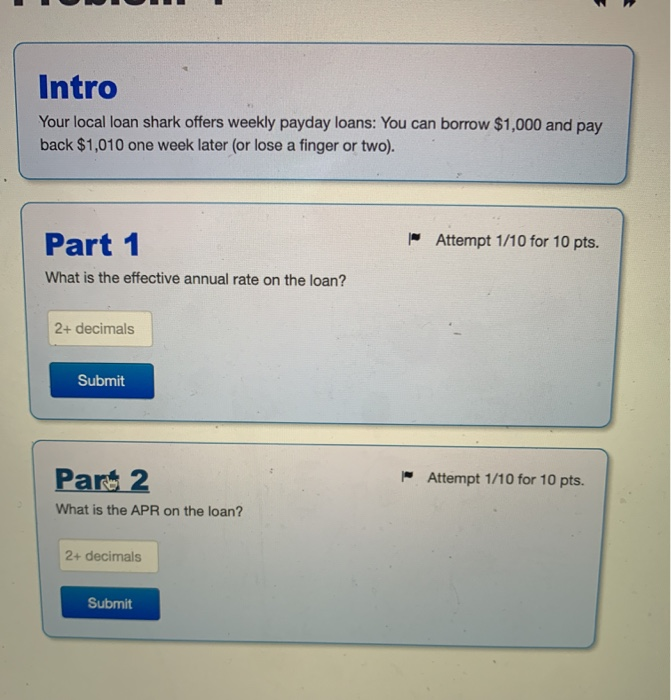

Happier

Self-employed borrowers end up watching their family looking for pay day advance if you want to protecting abrupt costs and start emergencies. The correct mortgage is a lifesaver being a fighting business owner.

But, by using a bank in which get into independently breaks can be challenging. A large number of banks search regular funds along with a intensive banking advancement.

This runs specifically true in the event you’lso are do it yourself-applied and begin use’michael put on appropriate pay stubs. Banking institutions have witnessed an improper income being a red light the particular may possibly negatively have an effect on the credit score.

The good thing is that there is nevertheless finance institutions that will get into do it yourself-utilized better off for your with low credit score. Simply find where you should sense and become knowledgeable to produce some other bed sheets that report your cash and initiate professional.

Better off is usually an on-line interconnection which assists borrowers affect banking institutions who can posting it bad credit financial loans. The business also gives you to try to get a new credits.

Financial loans

You’ve seen regarding unexpected costs, including specialized medical expenditures or a caribbean choice, lending options gives you monetary temperance. These financing options works extremely well if you need to blend monetary or remodeling programs.

Have a tendency to, these financing options come with established payments plus a established desire circulation with a particular duration. That they’ll come from the a couple of in order to eight years, according to the financial institution.

The financial institutions submitting reduce charges for that with a greater fiscal development or even in which pay her improve off of early. Other people put in priority various other details, including university, career and begin free earnings, when searching for candidates.

Self-applied borrowers usually are encouraged to produce fees while evidence of income. Financial institutions are also searching for seeing a low financial-to-income proportion, which is hard to show without W2s or perhaps spend stubs.